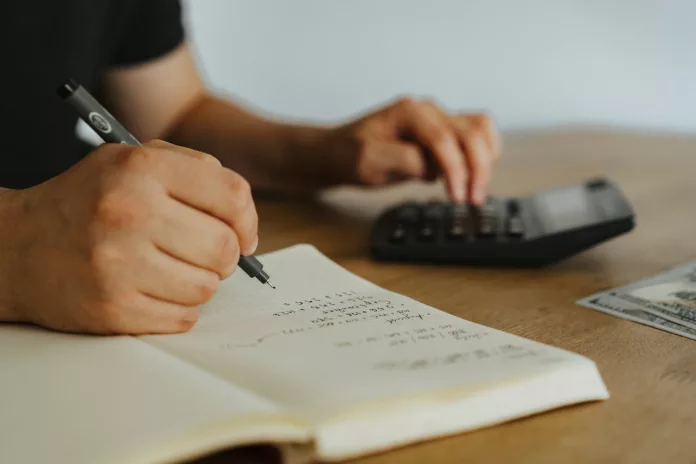

In today’s fast-paced business environment, maintaining accurate financial records is essential for success. From tracking expenses to managing revenue, businesses rely on efficient systems to keep their finances in order. Here are some strategies to help your business effectively manage financial information:

Implement Robust Accounting Software

Investing in robust accounting software that promotes revenue recognition is paramount for businesses looking to streamline their financial record-keeping processes. These software solutions offer a wide array of features designed to enhance efficiency and accuracy in managing financial data. With automated transaction recording capabilities, customizable reporting options, and real-time data analysis tools, accounting software simplifies complex financial tasks and provides valuable insights into the company’s financial health.

Establish Clear Financial Policies and Procedures

Clear financial policies and procedures provide guidelines for how financial transactions should be handled within the organization. These policies cover areas such as expense reimbursement, purchasing approvals, and financial reporting requirements. Regular training on financial policies and procedures can help employees understand their roles and responsibilities regarding financial management. Training sessions can cover topics such as proper expense documentation, approval processes, and compliance with regulatory requirements. By empowering employees with the knowledge they need to follow established procedures, businesses can reduce the risk of errors and fraud.

Regularly Reconcile Accounts

Regularly reconciling accounts is crucial for identifying discrepancies and errors in financial records. Reconciliation involves comparing financial transactions recorded in the accounting system with external sources such as bank statements, credit card statements, and vendor invoices. Any discrepancies should be promptly investigated and resolved to ensure the accuracy of financial data. Additionally, reconciliation helps businesses identify trends and patterns in their financial data, enabling them to make informed decisions about resource allocation and budgeting.

Utilize Cloud-Based Financial Management Solutions

Cloud-based financial management solutions offer numerous benefits for businesses, including accessibility, scalability, and data security. These platforms allow users to access financial data from anywhere with an internet connection, facilitating collaboration among remote teams and enabling real-time decision-making. Furthermore, cloud-based solutions often come with built-in security features such as data encryption, multi-factor authentication, and regular data backups, ensuring the confidentiality and integrity of financial information. With automatic updates and maintenance provided by the service provider, businesses can focus on their core operations without worrying about software maintenance or security vulnerabilities.

Conduct Regular Financial Reviews and Audits

Regular financial reviews and audits help businesses assess the accuracy and integrity of their financial information. These reviews involve analyzing financial statements, transaction records, and internal controls to identify areas for improvement and ensure compliance with regulatory requirements. Additionally, external audits conducted by independent auditors provide an objective evaluation of a company’s financial statements and internal controls.

Conclusion

Effective financial management is essential for the success and sustainability of any business. By implementing robust accounting software, establishing clear financial policies, regularly reconciling accounts, utilizing cloud-based solutions, and conducting regular financial reviews and audits, businesses can keep track of their financial information accurately and efficiently, enabling informed decision-making and strategic planning.

![[Viral Video] Wpcnt.com 2023: A Dive into Jannat Toha’s Viral Video Details](https://www.businesszillablog.com/wp-content/uploads/2023/10/viral-video-150x150.png)

![[UNCUT] Bashid Mclean Original Photo No Blur: Tania Head’s Unblurred Image Sparks Discussion Bahsid McLean la Photo Sin Miedo Al Ban](https://www.businesszillablog.com/wp-content/uploads/2023/09/image-4-786x420-min-150x150.png)