5 Purposes of a Personal Loan

As the times change, there has been a change in the financial patterns of individuals. You can perfectly see that in the spending patterns of a millennial when compared to the older generations. Their economic preferences are interestingly different. With the onset of a quick loan, you can see them trying to use this financial product whenever needed. To support their changing needs, several fintech companies have started unsecured personal loans of different types that serve one purpose – provide financial help whenever and wherever needed!

How Does Personal Loans Work?

Personal loans are categorized into two forms. One is a secured personal loan, where you offer collateral or any asset when a lender lends you money, and these assets are taken away from you if you cannot pay the lender the money you own. The other is the unsecured personal loan, where you are not required to keep anything as collateral. Instead, you are offered a loan based on your credit score. The interest rate, loan tenure, and EMI are decided based on this score, so the lower the score, the higher you will have to pay the interest rate on your personal loan.

An unsecured loan is an instant loan that you can take for making purchases or expenses like buying any gadget, paying tuition fees, paying small credit card debts or funding your small vacation trips. Make sure you don’t default because although your asset is not at risk with this loan, you can’t say that there are no repercussions. You risk tarnishing your credit score if you fail to make a monthly repayment or repay after its due date. And when your credit score is compromised, your interest rates on other loans increase; not to forget, the lender can even sue you for the outstanding debt.

5 Ideal Situations for Taking a Personal Loan

While we always recommend being careful and precisely judging your financial situation before taking a loan, there are always times when taking out a personal loan to fund your financial purchases can be the best alternative. Here are five ideal situations in which you can use a personal loan:

Wedding Costs

A wedding is often an event considered to be important in most people’s lives. Some like lavishly celebrating this special event and budgeting the expenses beforehand. However, there might be some instances where budgeting don’t go as planned — for example, going overhead in wedding venue tariff, food, jewellery, décor, or apparel. A personal loan can help in funding these last-minute needs.

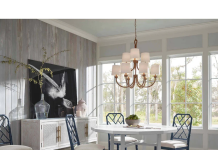

Big Purchases

Personal loans are flexible, and that’s the best part. Along with financing smaller purchases, it can also fund your major financial needs. For example, a personal loan can come in handy if there is a sudden need for a major automotive repair or the urgent need to buy a new washing machine. Although you will have to repay it with an added interest rate, replacing the electronic device or the automotive part is better than going for expensive alternatives like rental cars or spending money on repairing the unfixable electronic parts.

Travel Expenses

An unsecured personal loan can even cover financial requirements for travel-related purposes. For example, buying flight tickets, travel insurance, accommodation charges, or other such miscellaneous expenses.

Upgrading Your Lifestyle

Whether it is about pampering yourself by buying the latest gadget or upgrading your home for festivals or other important events, a personal loan can be an excellent option if you fall short on funds. Paying back in convenient EMIs for such purchases is better for some people than paying the entire amount out of their pocket in one go.

Financing Your Vehicle

Now you don’t have to worry about emptying your savings account or emergency funds for buying a vehicle. An unsecured personal loan can help you finance the vehicle of your dreams without putting in collateral.

Choosing the Right Lender

It’s important to select the correct lender that suits your financial requirements and needs so that you do not further fall into a debt trap. While at it, compare different financial lenders by assessing their interest rates, loan tenure, and EMIs. Ensure you thoroughly inspect the financial institution or baking partner you choose for a loan.

Author Bio:

Tanvi Kaushik specializes in Content Marketing and works with the Digital Team at KreditBee – India’s fastest personal loan platform where salaried professionals and self-employed can easily avail of personal loans in just a few minutes when in need of quick funds. Tanvi writes to-the-point articles on personal finance and budgeting which are truly appreciated by her readers. She is committed to making money matters easy to understand even for the layman. Her commitment to her work doesn’t stop her from pursuing her hobbies of hiking, trekking and going on adventurous trips.

![[Viral Video] Wpcnt.com 2023: A Dive into Jannat Toha’s Viral Video Details](https://www.businesszillablog.com/wp-content/uploads/2023/10/viral-video-150x150.png)

![[UNCUT] Bashid Mclean Original Photo No Blur: Tania Head’s Unblurred Image Sparks Discussion Bahsid McLean la Photo Sin Miedo Al Ban](https://www.businesszillablog.com/wp-content/uploads/2023/09/image-4-786x420-min-150x150.png)